Biden Plans Will Wreck the U.S. Economy.

This May 11, 2021 column by Peter Roff for American Action News is posted with his permission.

As slogans go, “build back better – which Joe Biden used to define his 2020 bid for the presidency – lags well behind “Happy Days Are Here Again,” “Make American Great Again,” and “I Like Ike” in clarity and vision. It’s not even close to “It’s the economy, stupid,” the unofficial campaign mantra of Bill Clinton’s successful run in 1992.

What Biden’s been doing during his first one hundred suggests even he didn’t understand what he meant. If he planned to create millions of new jobs – good jobs at good wages with good benefits as the Democrats used to say – the April jobs report indicates he’s failing.

What’s gone unreported is that jobs that are coming back – and there are some – are coming back as lockdowns are ending. The economic downturn that appears now to be ending was not the product of an expected downturn in economic activity but the direct result of state-by-state lockdowns that forced businesses to curtail operations or close as part of an ill-conceived effort to slow the spread of the coronavirus.

To supplement lost income, the Pelosi-led Congress joined first with Donald Trump and then with Biden to put the nation on relief. It’s no wonder, therefore, that business leaders are complaining they can’t find people to fill the jobs they have available once the Washington politicians incentivized joblessness instead of work by extending and enhancing unemployment benefits. It should be obvious that when you pay people not to work, they won’t work but somehow the experts in D.C. missed this.

Biden and the Democrats are nevertheless still all in. They said their $1.9 trillion “American Rescue Plan” would save the economy. Instead, it looks like it’s dragging it back down while inflation, a monster the U.S. Federal Reserve was thought to have tamed, is once again rearing its ugly head. The price of goods and services on which the American people rely are increasing, suddenly and sharply, as the impact of trillions in new spending during the pandemic comes home to roost.

Now, according to the Washington Post and other outlets, the Democrats are having trouble building support for their latest $4 trillion tax and spend program. Moreover, Democratic Congressional Campaign Committee Chairman Sean Patrick Maloney, D-N.Y., is now warning the White House its planned tax hike “could hurt vulnerable House Democrats up for re-election in 2022.”

It’s an important message for Biden – who’s apparently sending it back marked “Return to Sender.” The president, it seems, remains intent on raising taxes on as many people, goods, and services as he can convince Congress to accept.

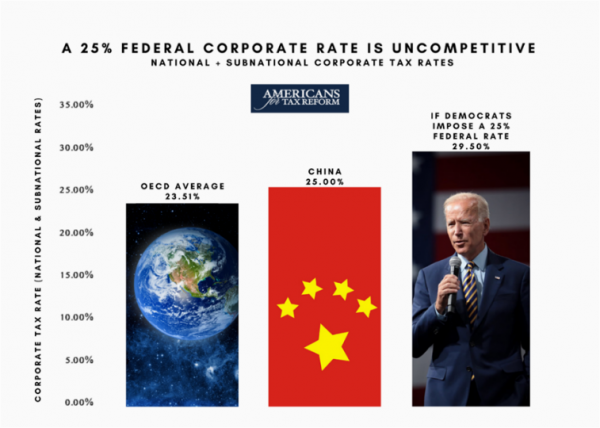

Biden’s initial proposal to take the corporate tax rate from 21 percent to 28 percent landed with such a resounding “thud” he was forced to offer up 25 percent as a compromise. Even so, that would still move the United States back into an uncompetitive position with the world’s other industrialized economies. What is being omitted thus far from the discussion is that, when state-corporate levies are added in, the average U.S. combined national and subnational tax rises to 25.77 percent.

At 25 percent, what Biden has now put on the table, the combined rate would be 29.5 percent, higher than what is levied by China and higher than the average rate for countries in the OECD.

Source: Americans for Tax Reform

Moreover, says Americans for Tax Reform, a non-partisan group opposed to tax increases, “Workers, consumers, and shareholders will bear the burden of an increased corporate tax rate. Such a hike will cause businesses to invest less in the United States and more overseas, resulting in fewer job opportunities and lower wages for American workers:”

According to ATR:

– A Treasury Department study estimated that “a country with a 1 percentage point lower tax rate than its competitors attracts 3 percent more capital.” This is because raising the corporate rate makes the United States a less attractive place to invest profits.

– A 2012 Harvard Business Review piece by Mihir A. Desai notes that raising the corporate tax lands “straight on the back” of the American worker and will see a decline in real wages.

– A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and studied over 55,000 businesses located in nine European countries over the period 1996-2003.

– Even the left-of-center Tax Policy Center estimates that 20 percent of the burden of the corporate income tax is borne by labor.

Biden’s insistence the corporate tax be raised, the cornerstone of his economic plan, will not create jobs, reduce debt, or bring increased revenues into the U.S. Treasury. It will however be a boon to almost every one of America’s competitors in the global marketplace.

Peter Roff is affiliated with several Washington, D.C. public policy organizations and is a former U.S. News and World Report contributing editor who appears regularly as a commentator on the One America News network. He can be reached by email at RoffColumns@GMAIL.com. Follow him on Twitter @PeterRoff.

——————————————————————————————————————————————————

Tell the President and our Representatives and Senators to say “NO” to higher taxes!

Contact them by clicking on their names below:

NH Representatives Chris Pappas (CD-1) and Anne Kuster (CD-2).

NH Senators Jeanne Shaheen and Maggie Hassan.

President Joe Biden.

Posted by GST Chairman Ray Chadwick