“Build Back Better” HR 5376 raises your taxes compared to the 2017 Tax Cuts and Jobs Act.

The 2017 Tax Cuts and Jobs Act limited federal deductions for state and local taxes to $10,000.

Previously, taxpayers in high tax states reduced their taxes by deducting about $500 Billion of income.

See “Trump Tax Plan Benefits New Hampshire, Oct. 17, 2017”

California taxpayers reduced annual Federal Tax income by $101 Billion; New York by about $60 Billion.

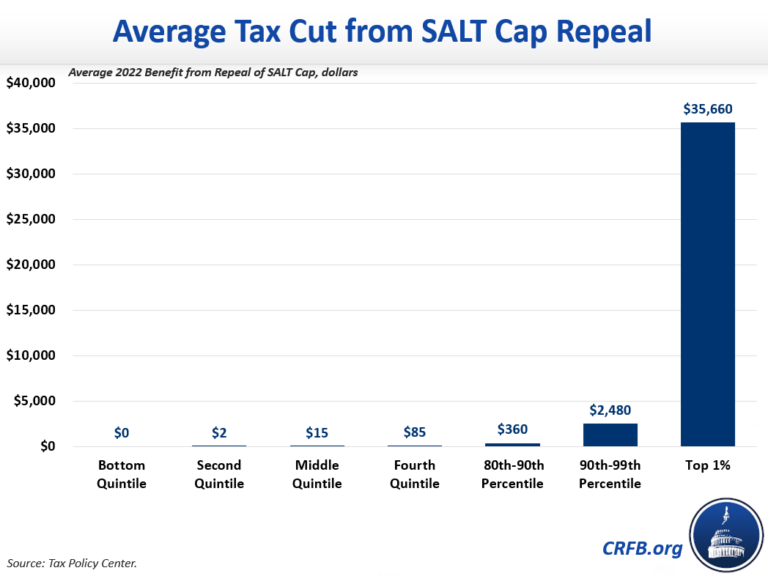

The “Build Back Better” Act lifts the cap on state and local tax (SALT) deductions for federal filers to $80,000.

The Committee for a Responsible Federal Budget shows this change actually reduces taxes for “the rich.”

Result: NH pays for a larger share of the Federal government, California keeps more tax money in state.

Result: NH pays for a larger share of the Federal government, California keeps more tax money in state.

The 2017 Tax Cuts and Jobs Act reduced tax rates for single and married filers and businesses.

It also simplified the tax code and promoted (until the pandemic) the econy and wage gains.

Click “GST Supports the Tax Cut and Jobs Act, Dec. 18, 2017″ to see the tax rates and other changes.

Americans for Tax Reform summarized the tax impacts of the “Build Back Better” Act:

Toolkit: Here’s What’s in the Dems’ Big Bill. House Democrats just passed the following:

– Highest personal income tax rate in the developed world: 57.4%

– Highest capital gains tax rate since the 1970s. “The average top marginal combined tax rate on capital gains would be nearly 37 percent.”

– Violates Biden’s middle class tax pledge to oppose any and all tax hikes on Americans making less than $400k.

– All 50 states will have a combined federal-state top marginal income tax rate above 50%. Eight states will pay a combined federal-state top marginal tax rate of over 60%.

– 87,000 new IRS auditors and agents.

– 50% increase in small business audits.

– IRS “enforcement” funding 23 times greater than “taxpayer services.”

– 1.2 million more annual IRS audits; about half will hit households making less than $75k.

– $2.5 billion special tax handout for trial lawyers.

– $8 billion home heating tax.

– $1.6 billion special tax handout for media companies of any size. Each company–broadcast, print, digital–can claim the tax handout for up to 1,500 employees.

H.R.5376 – The “Build Back Better” Act passed the US House 220 – 213 on Friday, November 19, 2021.

It was approved by our US Representatives, Democrats Chris Pappas (CD-1) and Anne Kuster (CD-2).

Click ““Build Back Better” Act Passes the US House of Representatives to see what else is in it beyond taxes.

Click here to read the text of the “Build Back Better Act.

The “Build Back Better” Act is currently under discussion in the US Senate Washington.

In the US Senate, Democrats will need all of their 50 Senators, plus the Vice President, to pass it.

That will require a vote by our US Senators, Democrats Jeanne Shaheen and Maggie Hassan.

You can click on their names for their contact information.

Tell them to vote NO on HR 5376: The Build Back Better Act!

Posted by GST Chairman Ray Chadwick.