There’s Some Bad News for NH Taxpayers this April 15th!

In contrast to Good News for Federal Taxpayers, the New Hampshire House is heading the wrong way!

The budget process begins with a budget proposed by the Governor. Click for a summary.

The House Majority budget proposed for 2020 – 2021 includes major spending increases and new taxes.

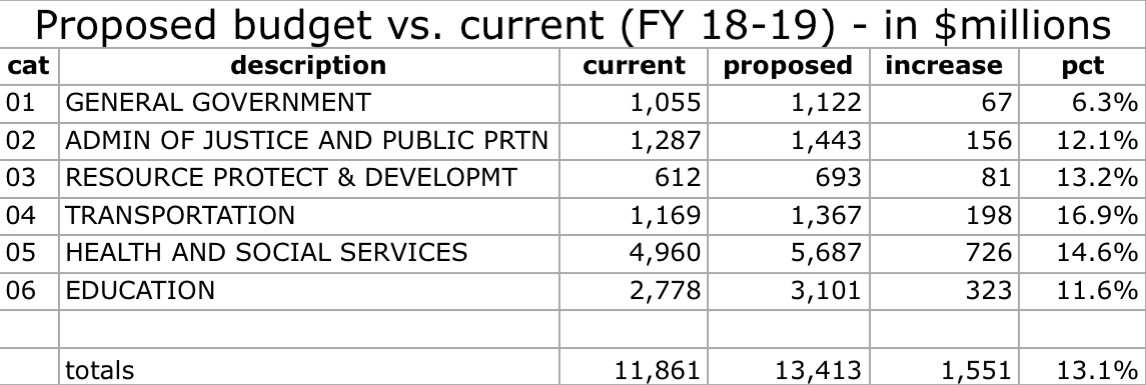

– Total spending increases by more than $1.5 billion, over the 2018 – 2019 budget, a 13% increase.

– Future business tax reductions in current law are eliminated, increasing tax $90 million over 2 years.

– A new capital gains tax is included, projected to cost taxpayers $150 million per year.

– A new 0.5% tax on wages to fund state-run family leave insurance will cost workers $168 million per year.

– Family leave insurance costs of $15 million to develop and 40 new government employees to administer it.

– One-time revenue is used to grow government, which will cause a structural deficit in future budgets.

– The rainy day fund receives $20 million less (FY19 through FY21 than the governor’s budget.

– Budget includes 157 new state employee positions at a cost of $23 million.

The 2020 – 2021 House Budget will undermine the New Hampshire Advantage and our prosperity.

– lowest state unemployment in the nation

– sixth highest state average per capita income

– economic growth

– net in migration to the State

That all reflects reforms and tax structures created by the Governor and prior Legislative majorities.

Click here to find your Legislators. Tell them that the House Budget will be bad for New Hampshire!