Advocates for higher taxes say they want to “Make the Rich Pay their Fair Share.”

They make the same “Not Paying their Fair Share” argument against any attempt to reduce tax rates.

That’s a seductive talking point for advocates of bigger government, but it’s hardly true.

The US tax code is progressive so that high earning taxpayers pay high shares of total taxes.

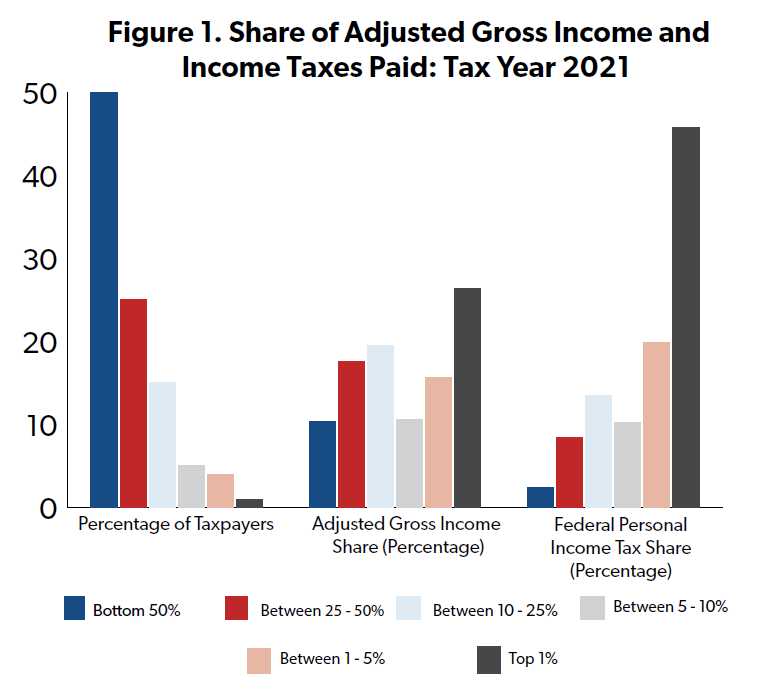

When GST posted “The Politics of Tax Reform”, on October 19, 2017, the distribution was as follows:

– Top 10% of taxpayers paid 69% of taxes

– Top 20% of taxpayers paid 81% of taxes

– Bottom 60% of taxpayers paid 3% of taxes

– Bottom 40% of taxpayers paid nothing.

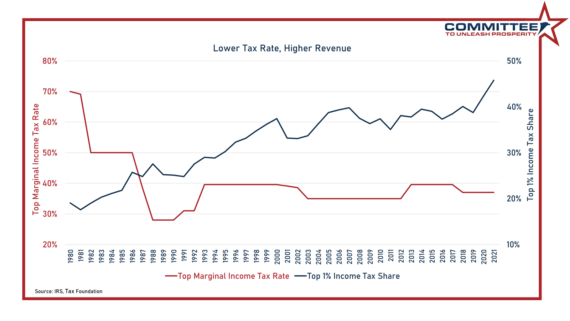

Reducing tax rates (Kennedy, Reagan, Clinton, Bush, Trump) leads to income and investment growth.

Also, they result in higher proportions of total taxes being paid by high income taxpayers.

That effect is evident in IRS data following passage of the Tax Cuts & Jobs Act in December 2017.

The Committee to Unleash Prosperity reported:

What “Trump Tax Cuts for the Rich?” the Wealthy Paid More Taxes, Not Less

Prior to Trump tax cuts the richest 1% paid roughly 40% of income taxes. Now they pay more than 45%.

The chart also shows that the top 1% paid more of the tax burden after Reagan cut the highest income tax rate from 70% to 28%.

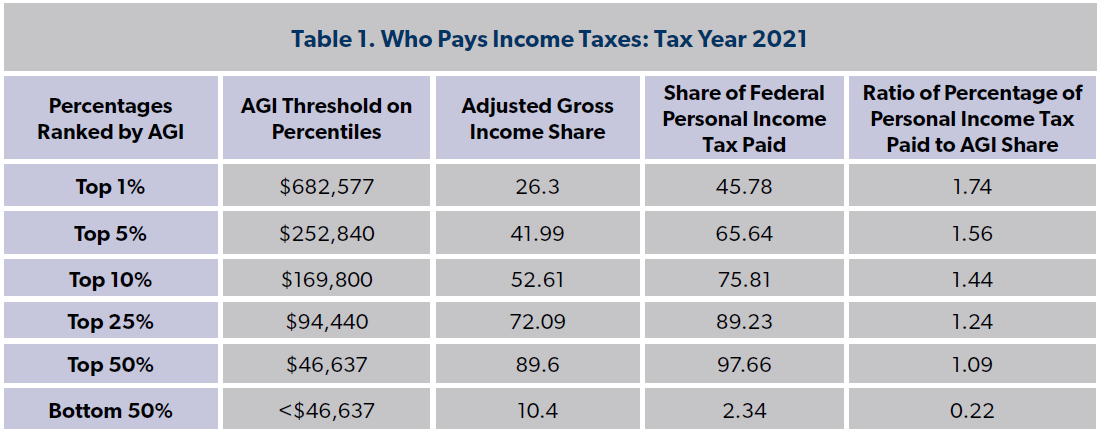

National Taxpayers Union has published a new report on “Who Pays Income Taxes?“

The IRS reports on the share of taxes paid by taxpayers across ranges of Adjusted Gross Income (AGI).

In 2021, the top 1 percent (with incomes over $682,577) paid nearly 46 percent of all income taxes.

The amount of taxes they paid is nearly twice as much as their share of Adjusted Gross Income (AGI).

So, compared to 2016 where the top 10% of earners paid 69% of taxes, they now pay 76%.

Anyone want to bet that these facts stop the whining about the Trump tax cuts “for the rich”? Not likely.

Posted by GST Chairman Ray Chadwick